All Categories

Featured

Table of Contents

It is necessary to keep in mind that your money is not straight bought the stock exchange. You can take cash from your IUL anytime, yet charges and surrender charges may be connected with doing so. If you require to access the funds in your IUL plan, weighing the advantages and disadvantages of a withdrawal or a loan is important.

Unlike straight investments in the stock market, your cash worth is not directly purchased the hidden index. How to Use IUL for Tax-Free Retirement Income Compared to 401(k). Rather, the insurer makes use of monetary instruments like alternatives to link your money worth growth to the index's performance. One of the special features of IUL is the cap and flooring rates

Upon the insurance holder's death, the beneficiaries obtain the death advantage, which is typically tax-free. The fatality benefit can be a fixed quantity or can include the cash money value, relying on the policy's framework. The cash value in an IUL policy expands on a tax-deferred basis. This means you do not pay tax obligations on the after-tax resources gains as long as the money continues to be in the plan.

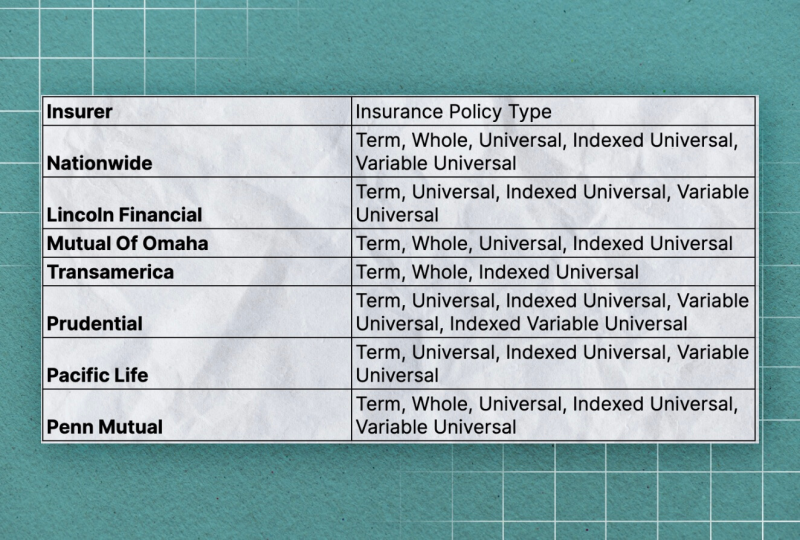

Constantly assess the policy's information and speak with an insurance coverage specialist to fully recognize the benefits, constraints, and costs. An Indexed Universal Life insurance policy plan (IUL) uses a special blend of functions that can make it an attractive alternative for certain people. Below are some of the vital advantages:: One of one of the most appealing elements of IUL is the capacity for higher returns compared to various other sorts of permanent life insurance policy.

Taking out or taking a financing from your plan may reduce its cash money worth, survivor benefit, and have tax obligation implications.: For those interested in tradition preparation, IUL can be structured to supply a tax-efficient method to pass wealth to the next generation. The survivor benefit can cover estate tax obligations, and the cash money worth can be an additional inheritance.

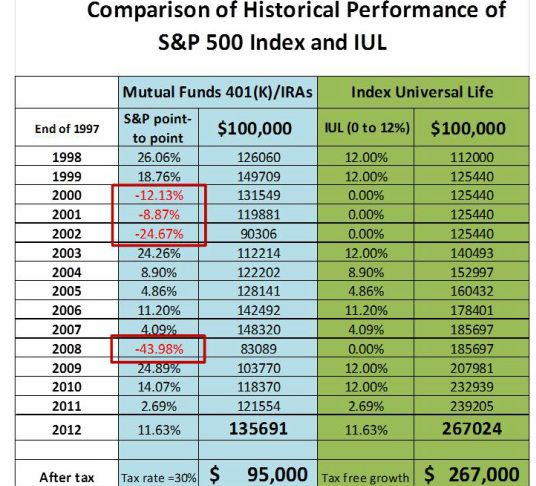

Indexed Life Insurance Vs 401k

While Indexed Universal Life Insurance Policy (IUL) supplies an array of benefits, it's important to take into consideration the possible downsides to make a notified choice. Below are several of the key negative aspects: IUL plans are extra intricate than conventional term life insurance policies or whole life insurance coverage policies. Recognizing just how the cash worth is linked to a stock market index and the effects of cap and floor prices can be challenging for the ordinary consumer.

The costs cover not only the price of the insurance however likewise administrative fees and the investment component, making it a pricier option. While the cash money worth has the possibility for development based upon a supply market index, that growth is often topped. If the index does extremely well in a provided year, your gains will certainly be restricted to the cap price specified in your policy.

: Including optional functions or cyclists can boost the cost.: Just how the plan is structured, consisting of just how the cash worth is designated, can also influence the cost.: Different insurance coverage companies have various prices versions, so looking around is wise.: These are charges for managing the policy and are generally subtracted from the cash money value.

What Are The Benefits Of Iul Vs. 401(k) For Retirement Planning?

: The prices can be similar, but IUL uses a flooring to aid safeguard against market declines, which variable life insurance policy plans generally do not. It isn't very easy to provide a specific expense without a certain quote, as rates can vary substantially between insurance coverage providers and private situations. It's important to balance the relevance of life insurance coverage and the need for added protection it provides with potentially greater costs.

They can assist you recognize the prices and whether an IUL plan straightens with your financial goals and demands. Whether Indexed Universal Life Insurance Policy (IUL) is "worth it" is subjective and depends on your monetary goals, danger resistance, and long-lasting planning requirements. Right here are some indicate take into consideration:: If you're trying to find a long-term financial investment lorry that offers a survivor benefit, IUL can be an excellent option.

The very best time to start getting ready for your long-lasting economic future is now. 2 of the very best ways you can do that is by purchasing a retirement, like 401(k), and an Index Universal Life Insurance Policy (IUL) policy. Recognizing the difference between IUL vs. 401(k) will certainly help you prepare successfully for retired life and your family's financial wellness.

Indexed Universal Life Vs 401(k): What Are The Tax Benefits?

In this instance, all withdrawals are tax-free since you have actually already paid tax obligations on that earnings. When you die, the funds in your 401(k) account will certainly be moved to your recipient. If you do not assign a recipient, the cash in your account will certainly come to be part of your to pay off any kind of arrearage.

You could grow your Roth IRA account and leave all the cash to your recipients. Furthermore, Roth IRAs use more financial investment choices than Roth 401(k) plans. Your only alternatives on a Roth 401(k) plan are those supplied by your plan carrier with.The downside of a Roth IRA is that there's an income restriction on who can contribute to an account.

Given that 401(k) strategies and Index Universal Life Insurance policy function differently, your savings for each depend on one-of-a-kind aspects. When contrasting IUL vs. 401(k), the very first action is to comprehend the overall purpose of retired life funds compared to insurance coverage advantages.

You should approximate your retirement requires based on your current income and the criterion of living you intend to maintain throughout your retirement. Typically, the cost of living doubles every two decades. You can use this rising cost of living calculator for even more exact results. If you locate 80% of your existing yearly earnings and increase that by 2, you'll get a price quote of the amount you'll need to make it through if you retire within the following twenty years.

If you take out about 4% of your retired life revenue annually (considering rising cost of living), the funds need to last about 30 years. On the contrary, when comparing IUL vs. 401(k), the value of your Index Universal Life Insurance coverage policy depends on aspects such as; Your present income; The estimated price of your funeral costs; The size of your family; and The income streams in your house (whether a person else is used or not).

Iul Instruments Sa

In reality, you do not have much control over their allotment. The primary purpose of irreversible life insurance policy is to supply additional monetary assistance for your household after you pass away. Although you can take out money from your cash worth account for individual needs, your insurance policy carrier will deduct that amount from your fatality advantages.

A 401(k) supplies earnings protection after retired life. Each offers a different purpose. That's not to claim you need to select between IUL vs. 401(k). You can have both an Index Universal Life insurance policy plan and a 401(k) pension. You ought to understand that the terms of these policies change every year.

All set to get started?!! I'll answer all your concerns regarding Index Universal Life Insurance Coverage and exactly how you can attain wide range before retired life.

Table of Contents

Latest Posts

Disadvantage Insurance Life Universal

Universal Aseguranza

Indexation Insurance

More

Latest Posts

Disadvantage Insurance Life Universal

Universal Aseguranza

Indexation Insurance